are hearing aids tax deductible in 2020

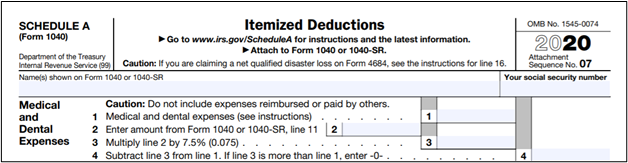

So if your AGI is 100000 per year you can typically deduct anything over 7500. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

Here S How To Make The Most Of The Tax Break For Medical Expenses

Medical expenses including hearing aids can be claimed if.

. Rainbow Desert Inn 3120 S Rainbow Blvd Ste 202 Las Vegas Nevada 89146 702-997-2964 Henderson 2642 W Horizon Ridge Ste A11 Henderson Nevada 89052. The cost of hearing aids can be as high as 75 of your adjusted gross income so. Hearing aids batteries maintenance.

Donations are tax-deductible and will be acknowledged in the Annual Report. 502 Medical and Dental Expenses. Can hearing aids be deducted as a business expense.

Examples of qualifying health expenses are payment for. Unfortunately it seems uncommon knowledge that the IRS will allow tax deductions for hearing aids and some associated items listed as medical expenses. After 2018 the floor returns to 10.

Expenses related to hearing aids are tax. Income tax rebate for hearing aids. Donate Donation Amount.

Since hearing loss is. After 2018 the floor returns to 10. You would claim the amount in this section to get the proper tax.

Select Payment Method Offline. Tax offsets are means-tested for people. Keep in mind due to Tax Cuts and Jobs Act tax reform the 75 threshold applies to tax years 2017 and 2018.

Using the standard medical expense deduction. As of mid-2020 there are no tax credits for hearing aids. The deduction is for.

Qualifying health expenses are for health care you have paid for. Hearing aids batteries maintenance costs and repairs are all deductible. Are hearing aids tax deductible in 2020.

Many of your medical expenses are considered eligible deductions by the federal government. The deductions for these costs are only available to those who itemize their expenses. Doctors and consultants services.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct. For example if you spend 8000 during the year you can deduct 500. For example you would use this line if you purchased hearing aids for your spouse at some point in 2020.

104 Gilbert AZ 85234 irs letter 6419 when will i get it Call Us Today. For goods and services not required or used other than incidentally in your personal activities. Fortunately the Federal Governmentthrough the Internal Revenue Service IRSdoes recognize hearing aids as a.

June 3 2019 1222 pm. Polite quotes for whatsapp.

Irs Announces That Face Masks And Related Purchases Are Tax Deductible

Does Medicare Cover Hearing Aids Lsh

Common Health Medical Tax Deductions For Seniors In 2022

Tax Tips For The Deaf Turbotax Tax Tips Videos

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Qualifying For Medical Expenses Tax Deduction Pkf Texas

Are Hearing Aids Tax Deductible Anderson Audiology

2020 Sept Oct Hearing Loss Association Of America

Great News For Tax Season Your Hearing Aids Are Deductible Hearing Associates Of Northern Virginia

Common Health Medical Tax Deductions For Seniors In 2022

What Students Need To Know About Filing Taxes This Year Money

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

Tax Breaks For Hearing Aids Sound Hearing Care

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Fda Upends The Hearing Aid Market By Permitting Sales Of Non Prescription Devices

Are Hearing Aids Tax Deductible Sound Relief Hearing Center